|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

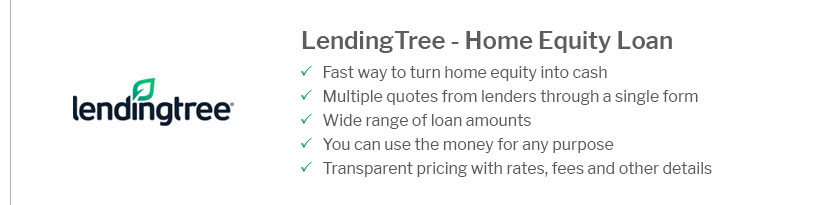

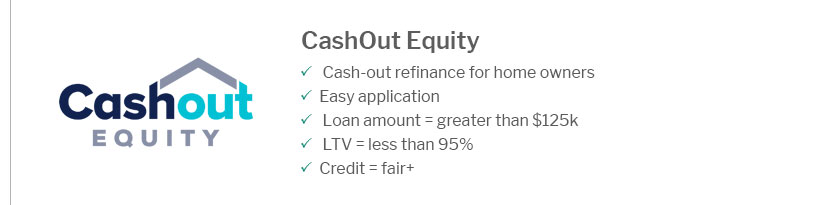

Understanding Home Equity Loan Options in Texas for Your Financial GoalsHome equity loans in Texas provide homeowners with a powerful tool to leverage the value of their property. This type of loan allows you to borrow against the equity you've built in your home, offering a way to access funds for various needs. In this article, we'll explore the benefits, requirements, and strategic uses of home equity loans in the Lone Star State. What is a Home Equity Loan?A home equity loan is a secured loan where the borrower uses the equity of their home as collateral. The loan amount is determined by the value of the property, and homeowners can use it for several financial goals. Benefits of Home Equity Loans

Eligibility and Requirements in TexasTo qualify for a home equity loan in Texas, homeowners must meet certain criteria. It's crucial to understand these requirements to ensure eligibility. Basic Eligibility Criteria

Consulting with a financial advisor can help you assess your situation and explore options like home refinance rates Utah if you're considering other states or refinancing options. Strategic Uses for Home Equity LoansHome equity loans can be used for a variety of purposes, each serving to enhance your financial situation or lifestyle. Common Use Cases

Understanding your options and potential savings can guide you in making informed decisions. For instance, exploring a VA streamline refinance might provide additional benefits if you're a veteran looking for refinancing options. Frequently Asked QuestionsWhat is the difference between a home equity loan and a HELOC?A home equity loan provides a lump sum with fixed interest rates, while a HELOC offers a line of credit with variable rates, similar to a credit card. Are there any risks involved with home equity loans?Yes, if you fail to repay, you risk losing your home since it's used as collateral. It's important to ensure that you can manage the loan payments. How long does it take to get a home equity loan in Texas?The process can take anywhere from 2 to 6 weeks, depending on the lender and your financial situation. https://www.gtfcu.org/greater-texas-cu/loans/personal/home-equity-loan

You can use that equity for home improvement projects, education expenses, consolidating your debts, and more with rates starting at 5.67% APR*. Plus, the ... https://www.frostbank.com/personal/banking/loan-products/equity

Apply for a Frost home equity loan and use the equity in your house to borrow money for almost any purpose like taxes or large purchases. https://www.rbfcu.org/home-loans-realty/home-equity-loans

If you have property in Texas, a home equity loan or home equity line of credit (HELOC) can be an economical way to obtain a low-rate loan.

|

|---|